First Time Home Buyer? This Blog is FOR YOU!

For a first time home buyer, it’s common to feel overwhelmed just thinking about where to start, what steps are involved, or what you need to research.

I’d like to explain the process of buying a home in the Hampton Roads area (which includes Virginia Beach, Norfolk, Chesapeake, Hampton, Portsmouth, Newport News, Suffolk, and Yorktown)— If you have any questions about buying or selling a home, whether or not they are covered in this blog, please feel free to contact me by email or phone, any day of the week, including weekends and holidays.

About the Home You Wish to Purchase

What kind of home would best suit your family’s needs? First, try making a list of what is “important” or “necessary” for you—such as home size, number of rooms, presence of a yard, type of home (single-family, condominium, townhouse), school district, and so on.

Websites Useful for Property Searches and Gathering Local Information

www.zillow.com

www.realtor.com

www.homes.com

www.homes.com

Are you planning to get a home loan? It’s a good idea to get a mortgage pre-approval from a lender in advance.

It’s recommended to contact several lenders and choose the one with the best terms and conditions for you. When you actually buy a home, you will be required to submit proof of pre-approval from your lender along with your offer. When you start seriously searching for a home, it’s best to obtain this pre-approval beforehand so you can make an offer as soon as you find a home you like.

Lenders who can provide pre-approval include mortgage departments at banks and mortgage companies (specialized mortgage firms). It’s recommended to use a local company with an office in the area, or a bank that can assign you a local representative who knows the region well. For pre-approval, you’ll need to provide information such as your approximate income, debt amount, and credit history. At this time, it’s also a good idea to ask about your desired monthly payment and get an estimate of the loan-related costs you’ll pay at closing.

Getting pre-approved does not lock you into working with that company, and there is no cost at this stage, so it’s best to contact several companies rather than just one. The interest rate for your loan is not locked in at the pre-approval stage; the final rate will be determined after you’ve chosen a home and your loan goes through full approval.

Things to talk with a mortgage lender:

- Types of loans (VA, FHA, Conventional)

- Down payment

- Mortgage interest rate

- Mortgage insurance

- Monthly payment

- Mortgage points

- Lender’s fee

Working with a Real Estate Agent – About the Buyer Broker Agreement

By law, home buyers and the real estate companies working with them as clients must sign a Buyer Broker Agreement in advance. The Buyer Broker Agreement must be signed at the house-hunting stage (specifically, before any home tours take place), otherwise, it is a legal violation. In the Hampton Roads area, the standard Buyer Broker Agreement is a five-page document. Before any property tours (including not only in-person tours but also virtual tours via FaceTime, video, or Zoom), we will go over the contents of this document together and have you sign it before proceeding with the tour.Things to Understand Before Making an Offer

Real estate laws differ in each state in the U.S. Virginia is a “Caveat Emptor” state, meaning the buyer is responsible for investigating the property they intend to purchase and is encouraged to ask the seller any questions in advance. The Buyer Disclosure Information Form, included with the offer, outlines the buyer’s responsibilities. Sellers are not obligated to research or provide information about the property for the buyer ahead of time. However, they are required to honestly answer any questions they are asked, if they know the answer. If they do not know, they may tell the buyer to investigate on their own. For example, in this area, there are many military facilities, so it’s important to check whether a home is in a jet crash zone or noise zone, find out about local schools, neighborhood crime rates, whether the area is designated as a flood zone or requires flood insurance, the history of the home, and whether it is part of a condominium or a Property Owners Association (POA/HOA). There are various matters you should research in advance. I strive to do my best in gathering information so that you can purchase with peace of mind. When making an offer, I will also research to ensure the property price is appropriate and not overpriced.

Knowledge Specific to Hampton Roads

There are a lot of military bases in this area, so you’ll often see (and hear!) jets and helicopters flying overhead for training. If you’re sensitive to noise, I recommend checking the AICUZ map in advance to see if there are any areas you might want to avoid.

Hampton Roads is a coastal community that stretches along the Chesapeake Bay. Even if you’re not super close to the ocean, there are plenty of natural waterways—like rivers and ponds—throughout the region. Before making an offer on a property, it’s really important to check if it’s located in a flood zone. You can use the FEMA Flood Map for this. Some areas are designated as flood zones even though they’re far from the sea. In recent years, many remodeled or newly built homes in flood zones have been constructed with higher foundations, so sometimes flood insurance isn’t required.

Ready to make an offer on a property?

When you make an offer, you’ll need to sig several documents, such as the Sales Agreement, Consumer Disclosure Form, and (optionally) the Property Inspection Contingency Form. The Sales Agreement includes important details like your offer price, loan information, down payment, whether you’ll have an inspection, property details, and the closing date. Once both the buyer and seller agree to and sign all the details, the contract is official. If either side doesn’t agree, the seller might send a counteroffer with new terms, and you’ll negotiate until both sides are happy.

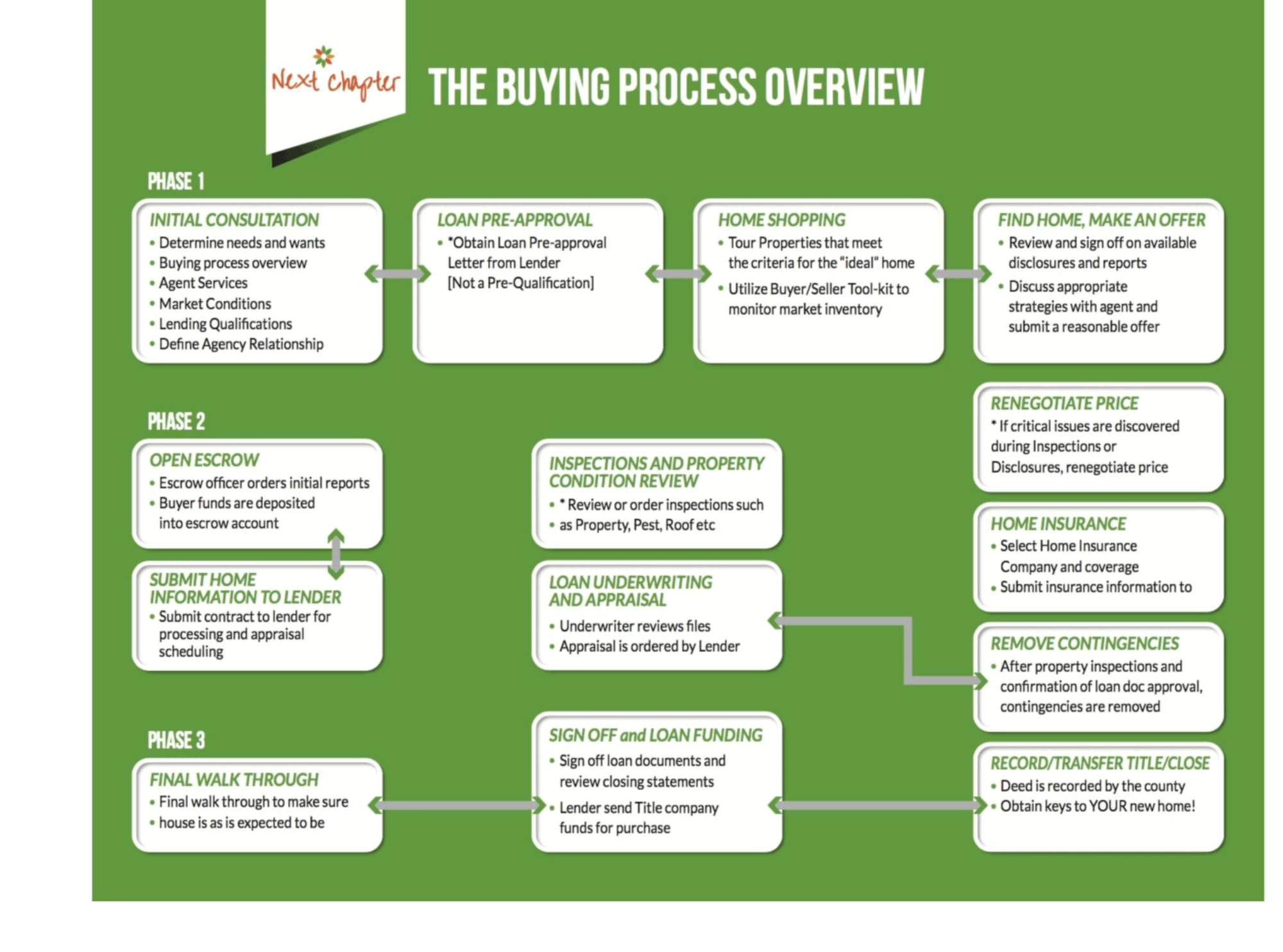

Steps from Contract to Closing:

Earnest Money Deposit

Earnest Money deposit needs to be made within two days after the contract is ratified. (this is held by the settlement company or a real estate attorney’s office until the closing date). This deposit shows the seller that you are serious about buying the home. If everything goes smoothly through to closing, this deposit is applied toward your closing costs and returned to you as the buyer. However, if you cancel the purchase for reasons that are your fault as the buyer, you may not get your Earnest Money back. For example, if you take out a large loan to buy a car or otherwise accumulate debt after the contract is signed and it prevents you from getting your mortgage, you may lose your deposit.

Property Inspection (Optional)

A Property Inspection is an optional inspection conducted by a licensed home inspector that the buyer hires to check the details of the home. The inspection covers everything from the foundation to the roof, including heating/cooling systems and appliances. The cost varies depending on the type and size of the home, and the buyer pays for it on or before the inspection date. If there is a fireplace or pool and you choose to have them inspected by a specialist, that will be an additional order and cost. If the inspection reveals major issues, the repair can be negotiated with the seller, or you may move forward with the purchase as is, or may withdraw from the contract.

Termite & Moisture Inspection (Required by Lender)

If you are purchasing with a mortgage, a termite and moisture inspection is required. Whether the buyer chooses the company and pays for it, or the seller does, is decided during contract negotiations. If the inspection finds any issues, the seller is responsible for repairs up to the agreed amount, and have to obtain a clear report from the inspection company.

Appraisal

The lender will request a property appraisal. The appraisal is an unbiased and reliable report that determines the fair market value (resale value) of the property, based on a database of recent comparable home sales in the area. Lenders use this report to decide if the property is being bought at an appropriate price and whether it is worth the amount of the mortgage. If the appraised value comes in lower than the agreed purchase price, the lender will not provide a loan for the full contract price. In this case, we’ll need to either renegotiate with the seller to lower the price or pay the difference out of pocket.

Underwriting – Final Mortgage Approval

When you make an offer on a home, you usually get a pre-approval based on a preliminary review by the lender. Once your offer is accepted, you move on to the full underwriting process. Here, the lender will carefully check your income, employment status, years at your job, debts, assets, and more. You’ll typically be asked to provide:

- Pay stubs from the past two months

- Tax returns (W-2s) from the past two years

- Proof of any additional income

- Bank statements from the past two months

- Proof of debts

- Other documents as requested by the lender

Homeowners Insurance & Property Tax

When you purchase a home with a mortgage, your homeowners insurance premium and property taxes are usually included with your monthly mortgage payment. The lender collects these payments and pays the insurance company and the city on your behalf. It’s a good idea to contact several insurance companies for quotes to find the best coverage and rate.

Closing Costs (Fees incurred at the time of closing)

The buyer’s closing costs vary depending on the type and details of the loan, the property’s tax amount, and other property-specific factors. On average, I recommend planning to pay at least 3%, and ideally 4%, of the purchase price to cover these costs. If you are purchasing with cash, you won’t have any loan-related fees- the closing costs will be a bit lower. Closing costs include various fees such as those for the lender, closing company, and real estate agents, as well as expenses for title examination, registration, taxes, appraisal, etc. Once the closing agent and the lender finalize the details of your closing costs and the exact amount you will need to bring to the closing, the closing agent will send you a 'Closing Disclosure'. We use a closing (Settlement) Company to handle the legal aspects, like the settlement and registering the property deed. I highly recommend using a real estate attorney’s office for this.

Final Walkthrough (Final inspection before closing)

The day before closing, or on the morning of the closing day, you will visit the property one last time. Here, you’ll check to make sure there are no new damages or changes that weren’t present before, and check on repairs, etc. If everything looks good, you’ll sign the documents, receive the keys, and officially become the new owner of the property. (Woohoo!)

Please reach out to me any time- I'm happy to answer the questions you may have.

Categories

Recent Posts